For decades the Costa Rica departure or exit tax (aka “departure tax” $29 per person) was paid at a counter in the airport before check-in. The “new” system including the departure tax in tickets has been phasing in since November of 2014. See Examples & Is It Included in My Ticket?

NOTE: mis-information on the internet created the opportunity for a scam.

So called “travel experts” on TripAdvisor and Facebook stating “all the airlines now collect the tax” are wrong. As of Oct 2019 the official Banco de Costa Rica departure tax collection desks (see photographic evidence below) are operating and a handful of airlines still require payment in person. We were told there is no official plan to eliminate all in person payments before 2021.

In fact, one major international carrier has backslid. We have no idea why but Lufthansa quit collecting the tax in the cost of tickets and is back on the list requiring payment in person.

Departure Tax Scam

Con artists in official looking uniforms have been approaching confused, disoriented or vulnerable looking travelers and offering to “help with the required exit/departure tax.” They’re using an unoccupied counter and provide an official looking form to fill out. They collect money – sometimes 2x-5x more than the real tax if they can talk the victim out of it – stamp the form and disappear.

Most victims never even realize they have been robbed because they didn’t know they’d already paid the tax and of course they’re allowed to check in for their flight…

This seems impossible in broad daylight at a modern airport crawling with police and constant video surveillance but it’s apparently been going on for over a year.

check-in tips | don’t pay double | overland is less | which airlines? | fare breakdown

Don’t Pay Twice!

People contact us asking how to request a refund when they pay twice – once on their ticket and again at the departure tax counter – but as far as we know there is no mechanism for refunds.

We’ve flown out of Costa Rica twice in 2018 and once in 2019 and each time we used the individual fare breakdowns on our tickets to be sure we paid in advance. Although the agents at the tax counter will help it is ultimately the responsibility of each traveler to make sure they pay the tax once and only once.

If the exit tax is included on your ticket go directly to check-in not the departure tax counter.

check-in tips | don’t pay double | tax fraud | overland is less | which airlines? | fare breakdown

Paying the Departure or Exit Tax at the Airport

In the extremely unlikely event that the departure tax for Costa Rica was not included in your airline ticket purchase price it must be paid before you check in at the airline counter for your flight.

Payments accepted in cash (U.S. dollars, Costa Rican Colones or a mix) or by VISA credit card (extra fees apply for credit card and they do NOT take American Express or MasterCard).

The tax is $29 per person (infants and children too whether they are occupying a seat or not) plus up to $10 credit card fees.

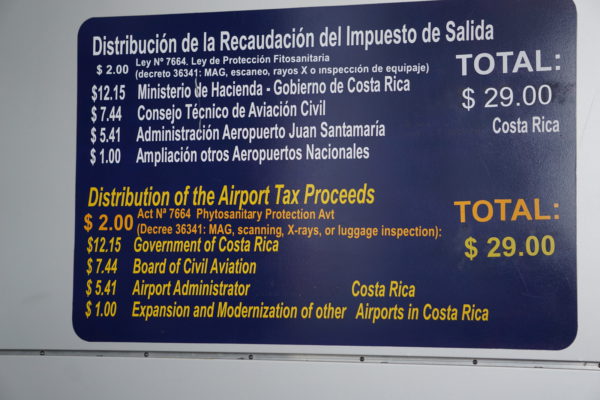

Most of the tax goes into the general fund of the Costa Rican government but some is used to improve airports, provide security and pay for marketing campaigns to try to attract more visitors…

Paying the Exit Tax in Advance

You may pay your departure tax in advance by presenting your passport at some participating hotel and resort’s front desks. Generally the hotels will charge you a service fee of $2 to $10 per person and accept the same methods of payment as at the airports.

check-in tips | don’t pay double | tax scam | overland is less | which airlines? | fare breakdown

Departure Tax Examples & Is It Included?

NOTE: If you’re traveling by land the departure tax is completely different and is not collected in advance.

There are several reasons to figure out if the departure tax is included in your airfare or not.

- If you’re looking for the best airfares you need to know that some include the extra $29 and some do not. If it’s not included you will have to pay it later increasing the effective fare.

- If you don’t know it has already been included you may pay it twice (once in the ticket and again at the airport).

- If it is included you can leave for the airport 15-30 minutes later because it’s one less line you have to wait in.

Because different airlines started collecting the tax at different times and collected it sporadically it’s not possible to make a list of airlines and “safe” dates for inclusion. Many people have told us their airline’s customer service phone representatives have no idea what the tax is or how to help.

Two independent notifications from the Asociación de Líneas Aéreas and the Aeropuerto Internacional Juan Santamaría official website combine to list the following major airlines that ARE collecting the tax as part of the ticket price (purchased on or after April 2019).

check-in tips | don’t pay double | tax fraud | overland is less | which airlines? | fare breakdown

Costa Rica Departure Tax Included by these Airlines

- Aeroméxico

- Air Canadá

- Air France

- Air Panama

- Alaska Airlines

- American Airlines

- Avianca

- British Airways

- Condor*

- Copa

- Delta

- Edelweiss

- Iberia

- Interjet

- Jetblue Airways

- KLM

- LACSA

- Lufthansa – sometimes but NOT NOW – for an indeterminate period Lufthansa did include the tax in the price of tickets but currently they are on the official list requiring payment in person in the airport for some flights!

- Southwest

- Spirit*

- Taca Airlines

- United Airlines

- Veca*

- Volaris

- Wingo*

- US Airways*

We’ve kept track of when some of the airlines were added to the list and the ones without a star (*) were more than a year ago. Since they only sell tickets a year in advance we can safely presume that if you have a ticket on any of these airlines it includes the tax.

Starred airlines have added the service more recently. That means that even if your airline is on the list now they may not have been back when you purchased your tickets…how to check your fare breakdown

check-in tips | don’t pay double | tax fraud | overland is less | which airlines? | fare breakdown

Costa Rica Departure Tax NOT Included by these Airlines

Other airlines that fly out of Costa Rica that MAY NOT collect the tax as of late 2019 are

- Air Transat

- Albatros

- Cubana

- LATAM

- Lufthansa – for an indeterminate period Lufthansa did include the tax in the price of tickets but currently they are on the official list requiring payment in person in the airport!

- SANSA

- WestJet

The only way to be sure you’ve paid is the look at the taxes and fees listed on your fare breakdown.

check-in tips | don’t pay double | scam & fraud | overland is less | which airlines? | fare breakdown

It Probably Won’t Say “Costa Rica Exit Tax”

That would be too simple. Each airline appears to have its own lingo but if your round trip tax total for flights from the U.S. is roughly $130 it probably is included and if the total is $100 it probably is not.

There are a couple of examples below of fare breakdowns. None of them list a “departure tax” or any single tax that is equal to the $29 total normally paid at the departure tax desk.

United lists “International Boarding Tax” and “Costa Rica Baggage Inspection Fee” totaling $29 – these are the departure tax.

American airlines also seems to be collecting the tax but their nomenclature is even harder to decipher. It seems that the $29 is listed as “Other Taxes” plus a “Sierra Leone – Immigration Fee” these are the departure tax. Obviously the itinerary doesn’t go anywhere near Sierra Leone and they’ve either made a mistake or are just using this as a bizarre placeholder. A reader who’s flying Delta wrote to tell us that the departure tax is included on his tickets and labeled “B1”

You’ll need to carefully inspect the tax breakdown on any tickets you purchase or consider purchasing.

United (included) |

total $130.93 |

| September 11th Security Fee | $5.60 |

| U.S. Passenger Facility Charge | $4.50 |

| U.S. Passenger Facility Charge | $4.50 |

| U.S. Transportation Tax | $17.70 |

| Costa Rica Tourism Arrival Tax | $15.00 |

| Costa Rica Security Fee | $1.52 |

| U.S. Transportation Tax | $17.70 |

| International Boarding Tax | $27.00 |

| Costa Rica Baggage Inspection Fee | $2.00 |

| Costa Rica Security Fee | $1.52 |

| Costa Rica Common Area User Charge | $6.29 |

| U.S. Customs User Fee | $5.50 |

| U.S. Immigration User Fee | $7.00 |

| U.S. APHIS User Fee | $5.00 |

| September 11th Security Fee | $5.60 |

| U.S. Passenger Facility Charge | $4.50 |

| United Airlines Total Adult Tax | $130.93 |

American (included) |

total $130.93 |

| U.S. Security Fee | $11.20 |

| U.S. Passenger Facility Charge | $13.50 |

| Costa Rica-Tourism Arrival Tax | $15.00 |

| Sierra Leone-Immigration Fee | $2.00 |

| Other Taxes | $27.00 |

| Costa Rica-Intl Security Fee | $3.04 |

| U.S. Transportation Tax | $35.40 |

| U.S. Aphis User Fee | $5.00 |

| U.S. Customs User Fee | $5.50 |

| Costa Rica-Common Area User Charge | $6.29 |

| U.S. Federal Inspection Fee | $7.00 |

check-in tips | don’t pay double | scam & fraud | overland is less | which airlines? | fare breakdown

Increases in the Costa Rica Departure Tax

A while back the president issued a decree raising the tax from $29 to $31 with the increase earmarked for animal welfare. Apparently no one could figure out how to collect the extra $2 so a few days later the executive branch announced that the decree was on hold indefinitely “for further study”.

The legislature is also working on a bill to increase the tax by $4 to support the Costa Rican Olympic team…stay tuned…