NOTE: As of April 1, 2022 the requirement that every un-vaccinated visitor to Costa Rica is required to prove they have travel insurance that covers Covid when they arrive at the airport has been eliminated. see details

No Coverage = No Refunds, No Exchanges & No Credits

Use it or lose it. It’s a standard policy for airfare, cruise reservations, and tickets to events like concerts. For international travel “use it or lose it” frequently extends to ground transportation, activities, tours and lodging which is why travel insurance was invented.

compare Prices & Benefits* | free Credit Card coverage | where to Buy? | Claims

Reservations are Normally 100% Prepaid and Non-Refundable

Without Travel insurance you will not receive refunds for missed nights lodging, unused transportation, un-ridden horses, un-zipped ziplines etc. as a result of illness, weather delays, missed flights, changing your mind, airline strikes, etc.

In Costa Rica reservations are typically prepaid (or the full cost is pre-authorized to your credit card). If you cancel or do not show up most are not refundable. It’s not malicious or greedy it simply reflects the reality that if you don’t show up for your Scuba lesson it’s unlikely anyone else is going to fly in from Manitoba at the last minute to take your spot.

PLEASE consider obtaining Travel Insurance for your Costa Rica vacation. We personally use the free insurance included with some premium credit cards.

compare Prices & Benefits* | free Credit Card coverage | where to Buy? | Claims

Trip Insurance Cost & Benefits?

When shopping it helps to have an idea of what it costs to insure your trip. Costs varies with coverage, trip location and length as well as your age (when emergency medical coverage is included).

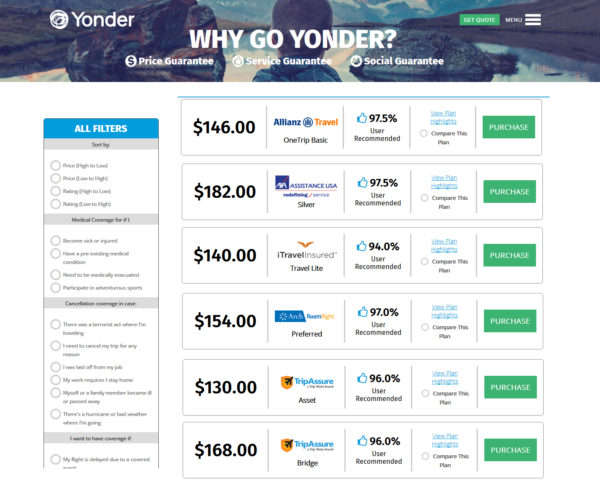

Yonder provides a convenient way to compare coverage and cost from multiple insurance companies then filter for travel cost only, medical, weather etc. Instant quotes with no e-mail, phone or sign-up required. *If you choose one of the plans from the price comparisons using this link we will receive a referral fee.

We found quotes from $130 to $462 to cover the $4,222 total cost of a two week trip for two 50 year olds.

The cheapest had basic coverage and limits on valid reasons for cancellation. The highest cost plan was of course more generous and flexible.

| Cost of Trip | $4,222 | $4,222 |

| Cost of Travel Insurance Plan | $148 | $462 |

| Cancellation | $4,222 | $4,222 |

| Interruption | $4,222 | $6,333 |

| Emergency medical/dental | $10,000 | $50,000 |

| Emergency medical transportation | $50,000 | $1,000,000 |

| Existing medical condition cancellation | $4,222 | $4,222 |

| Accident | $50,000 | |

| Baggage | $500 | $1,500 |

| Baggage delay | $100 | $500 |

| Trip delay | $150 | $1,000 |

| Travel company goes out of business | $4,222 | $4,222 |

| Collision/Theft Rental Car Coverage | $50,000 | |

| Electronic/Sporting Equipment Coverage | $1,000 |

All of the plans require valid reasons for claims – these may include death, injury, birth and illness for the travelers and immediate family members; air travel problems due to weather, strikes etc. There were a few oddball reasons like being the victim of an assault, jury duty and your house burning down. Whatever happens check the fine print; you may be covered.

Only travelguard.com ($445) included “We just decided not to go” as a valid reason for cancelling. Some others include reasons like “Required to work” which could probably be substituted for “we changed our minds” with a note from your boss.

compare Prices & Benefits* | free Credit Card coverage | where to Buy? | Claims

How & Where to Buy Travel Insurance

We recommend travel insurance because we have seen a number of people burned by the unexpected when traveling without it. In fact earlier this year we put $37,000 of emergency and intensive care charges on our credit card when a friend was hit by a car.

We have had good experience with – Yonder is a BBB registered insurance comparison site that shows rates from a number of companies and pays us a referal fee if you choose one of the recommended companies. If you’d prefer to . Also recommended Allianz Travel, Travel Insured, Assitance U.S.A., and Trip Assure

Free Trip Insurance

We generally don’t pay for trip insurance. Instead we use the free trip cancellation and travel insurance included in our Citi – Double Cash credit card. We are automatically covered when we pay for travel with our card.

The Citi coverage on the business MasterCard we have is similar to the less expensive paid plans. Check with your card issuer for details of your credit card travel insurance plan (if any).

- Up to $3,000 per person per trip refunded if the trip has to be cancelled or is delayed due to death or illness of any of the travelers, family members or pets, weather, terrorism and a number of other reasons.

- Covers hotels, transportation, tours and other non-refundable travel expenses

- It also includes $250,000 Common Carrier accident insurance, emergency flights home, travel for significant others or dependents to come to you if you’re hospitalized.

- Our credit card benefit does not include the payment of any medical bills. It is not health insurance.

Nothing in life is free, “there must be a catch” you say – you’re right. The average consumer pays several hundred to a few thousand dollars in hidden bank and credit card fees every year. They are called merchant discount fees and are added into the price of everything you buy (whether you use credit cards or not). The bank’s profits total about $50,000,000,000.00 a year (yes that’s the correct number of zeros) and taking advantage of “free” travel insurance is just one way you can get a tiny fraction of it back.

compare Prices & Benefits* | free Credit Card coverage | where to Buy? | Claims

Making a Claim

Regardless of whether you purchase coverage or use a credit card benefit you will need documentation to make a claim.

A certified licensed travel planner like Pacific Trade Winds (recommended) will provide you with an itemized invoice or fax/mail it directly to the claim office in the event you need to file.

If you book your travel independently save your receipts. You will need to provide written documentation of each non-refundable air ticket, hotel stay, tour, transfer and activity. You will also need to document any partial refunds issued or if any credits for future travel are available.

Insurance is recommended but not required. As of April 1, 2022 the vaccine mandate and all other Covid related entry and travel restrictions for Costa Rica have been suspended.

- No testing required

- No vaccination required

- No “pase de salud” electronic health pass required

- No travel insurance required

- No QR codes required

All covid related requirements and restrictions have been eliminated for entry into and travel around Costa Rica. At the end of April the requirement for mask use indoors was the last to be eliminated.